UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934, as amended

Filed by the Registrant x

Filed by a party other than the Registrant ¨

Check the appropriate box:

| | | | |

| ¨ | | Preliminary Proxy Statement |

| |

| ¨ | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| |

| x | | Definitive Proxy Statement |

| |

| ¨ | | Definitive Additional Materials |

| |

| ¨ | | Soliciting Material under ss.Materialunder § 240.14a-12 |

|

| FIRST COMMUNITY BANCSHARES, INC. |

FIRST COMMUNITY BANCSHARES, INC.

(Name of Registrant as Specified in Its Charter)

Not Applicable

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

x No fee required.

¨ Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

1. Title of each class of securities to which transaction applies:

2. Aggregate number of securities to which transaction applies:

3. Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

| | | | |

| (Name of Registrant as Specified in Its Charter) |

|

Not Applicable |

| | | | |

| (Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

|

| Payment of Filing Fee (Check the appropriate box): |

| |

| x | | No fee required. |

| |

| ¨ | | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | |

| | 1. | | Title of each class of securities to which transaction applies: |

| | | | |

| | 2. | | Aggregate number of securities to which transaction applies: |

| | | | |

| | 3. | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | | | The filing fee was determined based on________on |

| | | | |

| | 4. | | Proposed maximum aggregate value of transaction: |

| | | | |

| | 5. | | Total fee paid: |

| | |

| | | | |

| | | | |

| |

| ¨ | | Fee paid previously with preliminary materials. |

| |

| ¨ | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | |

| | 1. | | Amount Previously Paid: |

| | | | |

| | 2. | | Form, Schedule or Registration Statement No.: |

| | | | |

| | 3. | | Filing Party: |

| | | | |

| | 4. | | Date Filed: |

| | | | |

4. Proposed maximum aggregate value of transaction:

5. Total fee paid:

¨NOTICE OF 2013 ANNUAL MEETING OF STOCKHOLDERS Fee paid previously with preliminary materials.

¨ Check box if any part ofApril 30, 2013 at 11:30 a.m. Eastern Daylight Time

Corporate Center

29 College Drive

Bluefield, Virginia 24605

March 13, 2013

To the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

1. Amount Previously Paid:

2. Form, Schedule or Registration Statement No.:

3. Filing Party:

4. Date Filed:

Stockholders:First Community Bancshares, Inc.’s Annual Meeting of Stockholders will be held at the Corporate Center, located at 29 College Drive, Bluefield, Virginia 24605 at 11:30 a.m. Eastern Daylight Time on Tuesday, April 30, 2013. Following a report of the Corporation’s banking and related business operations, stockholders will:

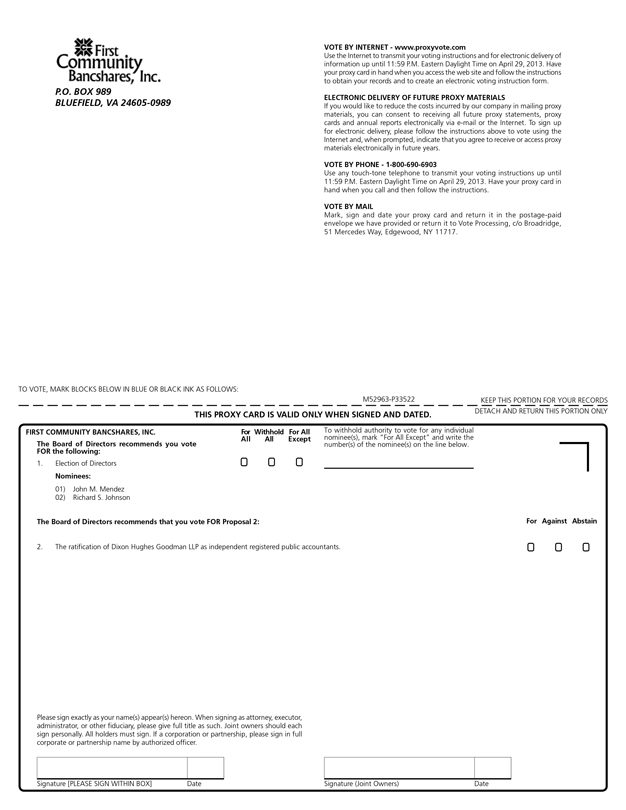

Vote on the election of two directors to serve as members of the Board of Directors, Class of 2016;

OneVote on ratification of the selection of the independent registered public accounting firm for 2013; and

Transact other business that may properly come before the meeting.

Stockholders of record at the close of business on March 1, 2013 will be entitled to vote at the Annual Meeting and any adjournments.

|

| /s/ Robert L. Buzzo |

Robert L. Buzzo Secretary |

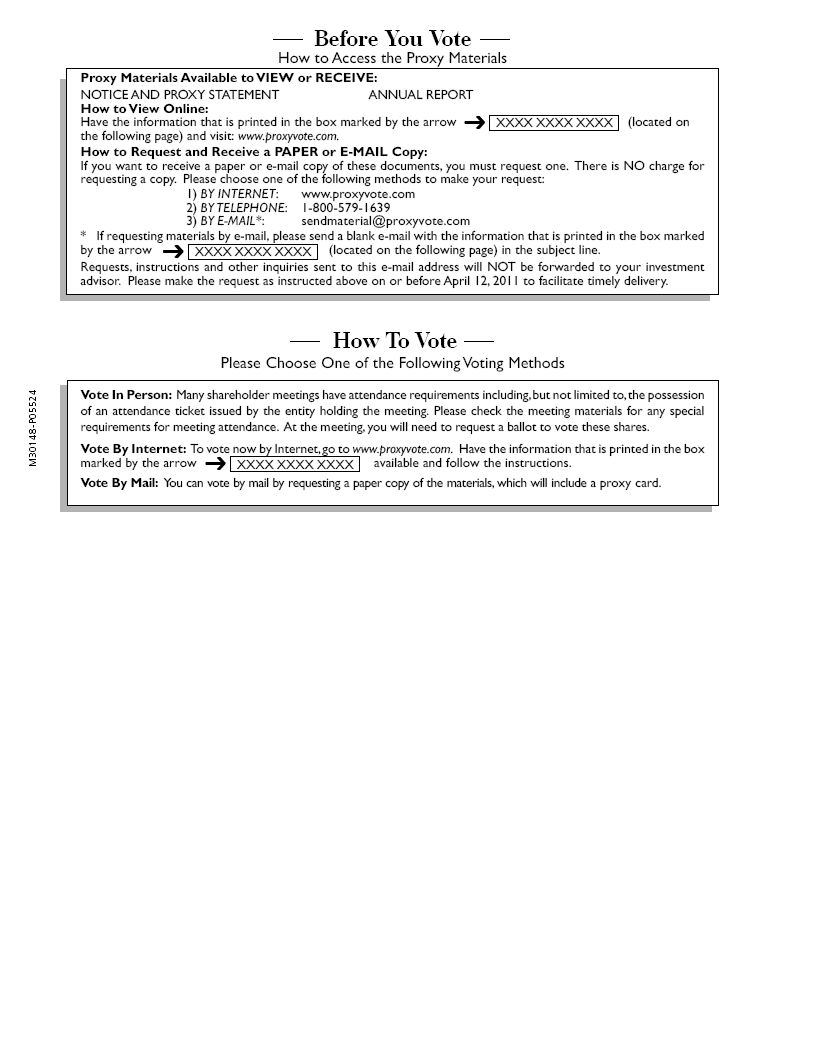

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE ANNUAL MEETING OF STOCKHOLDERS TO BE HELD ON APRIL 30, 2013.

The proxy materials for this Annual Meeting of Stockholders of First Community Place

Bancshares, Inc., consisting of the proxy statement, annual report, and form of proxy are available over the Internet at http://www.fcbinc.com.If you want to receive a paper or e-mail copy of these documents, or similar documents for future stockholder meetings, you must request the copy. There is NO charge for requesting a copy. In order to facilitate timely delivery, your request should be received no later than April 13, 2013. Please choose one of the following methods to make your request:

1. By Internet atwww.proxyvote.com;

2. By telephone: (800) 579-1639; or

3. By e-mail: sendmaterial@proxyvote.com.

All persons attending the 2013 Annual Meeting must present photo identification. Please follow the advance registration instructions on the back cover of this proxy statement.

WHETHER OR NOT YOU ATTEND THE ANNUAL MEETING, YOUR VOTE IS IMPORTANT TO FIRST COMMUNITY BANCSHARES, INC. YOU MAY VOTE BY THE FOLLOWING METHODS:

1. By telephone: (800) 690-6903 until 11:59 p.m. Eastern Daylight Time on April 29, 2013; or

2. On the Internet at http://www.proxyvote.com until 11:59 p.m. Eastern Daylight Time on April 29, 2013; or

3. Complete, sign and return the enclosed proxy as promptly as possible whether or not you plan to attend the Annual Meeting. An addressed return envelope is enclosed for your convenience.

FIRST COMMUNITY BANCSHARES, INC. ENCOURAGES STOCKHOLDERS TO SUBMIT THEIR PROXIES IN ADVANCE OF THE ANNUAL MEETING. YOU MAY REVOKE YOUR PROXY AT ANY TIME PRIOR TO THE TIME IT IS VOTED.

First Community Bancshares, Inc.

29 College Drive

P. O. Box 989

Bluefield, Virginia 24605-0989

13, 2013Dear Stockholder,

You are invited to attend the 20112013 Annual Meeting of Stockholders of First Community Bancshares, Inc. (the “Corporation”) to be held on Tuesday, April 26, 201130, 2013 at Fincastle Country Club, 1000 Country Clubthe Corporate Center located at 29 College Drive, Bluefield, Virginia.

The annual meetingAnnual Meeting will begin with a report of ourthe Corporation’s operations. This report will be followed by discussion and voting on the matters set forth in the accompanying notice of annual meetingAnnual Meeting and proxy statement and discussion of other business matters properly brought before the meeting.

If you plan to attend the meeting, please follow the registration instructions on the last page of this proxy statement. All persons attending the 20112013 Annual Meeting of Stockholders must present photo identification.

Whether or not you plan to attend, please ensure that your shares are represented at the meeting by promptly voting and submitting your proxy by telephone, on the Internet, or by completing, signing, dating and returning your proxy form in the enclosed envelope.

|

| Very truly yours, |

| |

| /s/ William P. Stafford, II |

| William P. Stafford, II Chairman of the Board |

Notice of 2011 Annual Meeting of Stockholders

April 26, 2011 at 11:30 a.m.

Fincastle Country Club

1000 Country Club Drive

Bluefield, Virginia 24605

March 11, 2011

To the Stockholders:

PROXY STATEMENT

First Community Bancshares, Inc.’s Annual Meeting of Stockholders will be held at Fincastle Country Club, located at 1000 Country Club

29 College Drive Bluefield, Virginia 24605 at 11:30 a.m. local time on Tuesday, April 26, 2011. Following a report of the Corporation’s banking and related business operations, stockholders will:

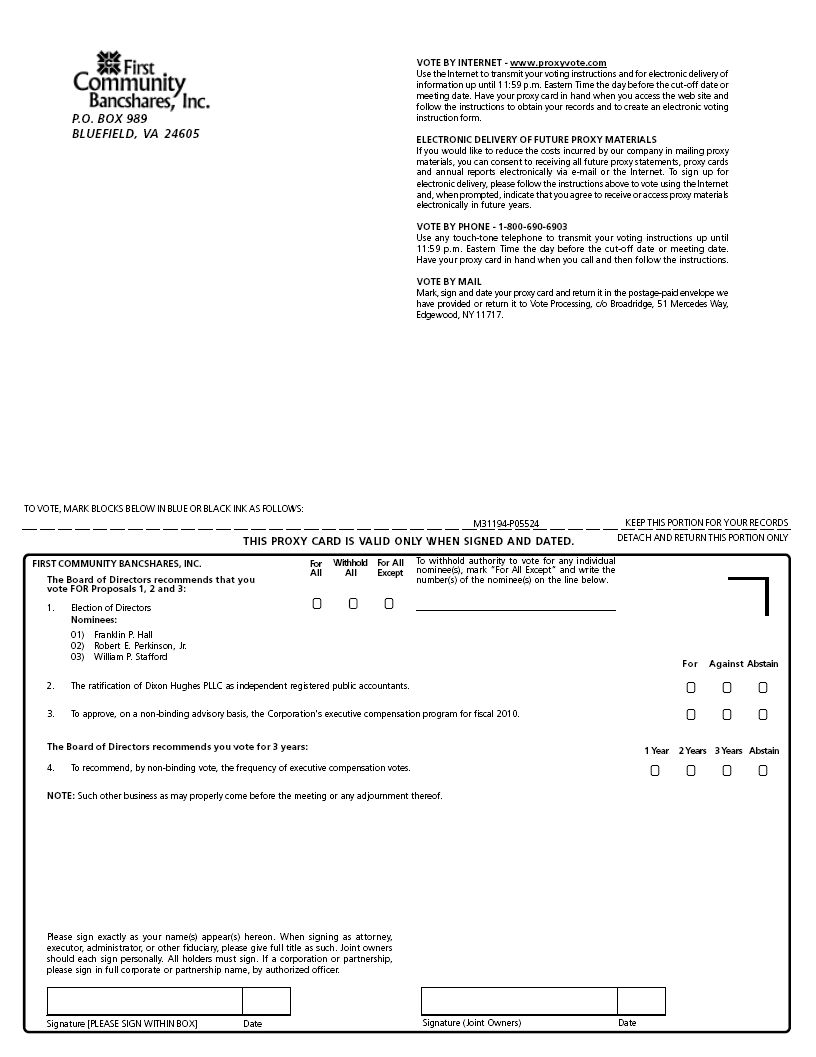

| · | Vote on the election of three (3) directors to serve as members of the Board of Directors, Class of 2014; |

| · | Vote on ratification of the selection of the independent registered public accounting firm for 2011; |

| · | Vote on non-binding, advisory approval of the Corporation’s executive compensation; |

| · | Vote on non-binding, advisory approval of frequency of future advisory approvals of the Corporation’s executive compensation; and |

| · | Transact other business that may properly come before the meeting. |

Stockholders of record at the close of business on March 1, 2011 will be entitled to vote at the Annual Meeting and any adjournments.

Robert L. Buzzo, Secretary

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE ANNUAL MEETING OF STOCKHOLDERS TO BE HELD ON APRIL 26, 2011.

The proxy materials for this Annual Meeting of Stockholders of First Community Bancshares, Inc., including the proxy statement and annual report, are available on the Internet at http:www.fcbinc.com

All persons attending the 2011 Annual Meeting must present photo identification. Please follow the advance registration instructions on the back cover of this proxy statement.

WHETHER OR NOT YOU ATTEND THE ANNUAL MEETING, YOUR VOTE IS IMPORTANT TO US. YOU MAY VOTE BY THE FOLLOWING METHODS:

1. By telephone: (800) 690-6903 until 11:59 p.m. Eastern Daylight Time on April 25, 2011; or

2. On the Internet at http://www.proxyvote.com until 11:59 p.m. Eastern Daylight Time on April 25, 2011; or

3. Complete, sign and return the enclosed proxy as promptly as possible whether or not you plan to attend the meeting. An addressed return envelope is enclosed for your convenience.

WE ENCOURAGE STOCKHOLDERS TO SUBMIT THEIR PROXIES IN ADVANCE OF THE MEETING. YOU MAY REVOKE YOUR PROXY AT ANY TIME PRIOR TO THE TIME IT IS VOTED.

PROXY STATEMENT

First Community Bancshares, Inc.

One Community Place

Bluefield, Virginia 24605

The Board of Directors of First Community Bancshares, Inc. (the “Corporation”, “FCBI”, “First Community”, “we”, “us”, and “our”) solicits the enclosed proxy for use at the Annual Meeting of Stockholders of the Corporation (the “Annual Meeting”), which will be held on Tuesday, April 26, 2011,30, 2013, at 11:30 a.m. local timeEastern Daylight Time at Fincastle Country Club, 1000 Country Clubthe Corporate Center, 29 College Drive, Bluefield, Virginia and at any adjournment thereof.

The expenses of the solicitation of the proxies for the Annual Meeting, including the cost of preparing, assembling and mailing the notice, proxy statement and return envelopes, the handling and tabulation of proxies received, and charges of brokerage houses and other institutions, nominees or fiduciaries for forwarding such documents to beneficial owners, will be paid by the Corporation. In addition to the mailing of the proxy material,materials, solicitation may be made in person, by telephone or by other means by officers, directors or regular employees of the Corporation.

This proxy statement and the proxies solicited hereby are being first sent or delivered to stockholders of the Corporation on or about March 11, 2011.

Shares of common stock (par value $1.00 per share) (“Common Stock”) represented by proxies in the accompanying form, which are properly executed and returned to the Corporation, will be voted at the Annual Meeting in accordance with the stockholder’s instructions contained therein. In the absence of contrary instructions, shares represented by such proxies will be voted FOR the election of the three (3)two directors nominated by the Board of Directors and named in this proxy statement and FOR ratification of Dixon Hughes PLLCGoodman LLP as the Corporation’s independent registered public accounting firm, FOR approval, on a non-binding advisory basis, of the Corporation’s executive compensation, and FOR approval, on a non-binding advisory basis, a frequency of every “THREE (3) YEARS” for future stockholder advisory votes on the Corporation’s executive compensation.

firm.Any stockholder has the power to revoke his or her proxy at any time before it is voted. A proxy may be revoked at any time prior to its exercise by the filing of written notice of revocation with the Secretary of the Corporation, by delivering to the Corporation a duly executed proxy bearing a later date, or by attending the Annual Meeting and voting in person. If your FCBI shares of Common Stock are held for you in a brokerage, bank or other institutional account, you must obtain a proxy from that entity andinstitution, bring it with you to the Annual Meeting and submit it with your ballot in order to be able to vote your shares at the meeting.

Annual Meeting.The Board of Directors has fixed March 1, 20112013 as the record date for stockholders entitled to notice of and to vote at the Annual Meeting. Shares of Common Stock outstanding on the record date are entitled to be voted at the Annual Meeting and the holders of record will have one (1) vote for each share so held in the matters to be voted upon by the stockholders. Treasury shares are not voted. Individual votesShares of stockholdersthe Corporation’s Series A Preferred Stock are kept private, except as appropriatenot entitled to meet legal requirements. Access to proxies and other individual stockholder voting records is limited to certain employees of First Community and its agents who acknowledge their responsibility to comply with this policy.be voted on the matters presented at the Annual Meeting. Stockholders of the Corporation do not have cumulative voting rights. As of the close of business on March 1, 2011,2013, the outstanding shares of the Corporation consisted of 17,868,67320,048,284 shares of Common Stock and no17,421 shares of preferred stock.

The presence in person or by proxy of a majority of the shares of the Common Stock entitled to vote is necessary to constitute a quorum at the Annual Meeting. Abstentions and broker non-votes, which are discussed below, are considered in determining the presence of a quorum. Directors are elected by a plurality of the votes cast at a stockholders’ meeting with a quorum present. The three (3)two persons who receive the greatest number of votes of the holders of Common Stock represented in person or by proxy at the Annual Meeting will be elected directors of the Corporation. Approval of the ratification of the independent registered public accounting firm and the advisory approval of the Corporation’s executive compensation program each requirerequires that the number of votes cast in favor of the proposal exceeds the number of votes cast against. The advisory approval of the frequency for future stockholder advisory votes on the Corporation’s executive compensation requires that the stockholder choose a frequency of one (1) year, two (2) years, three (3) years, or abstain, with the frequency that receives the highest number of votes cast deemed as the frequency for future advisory votes on executive compensation selected by stockholders. Abstentions and broker non-votes will have no effect on the election of the three (3)two directors nominated by the Board of Directors and named in this proxy statement and the ratification of the independent registered public accounting firm, the advisory approval of the compensation of the Corporation’s named executives, or the advisory approval of the frequency for future stockholder advisory votes on the compensation of the Corporation’s named executives.

firm.

If the shares you own are held in “street name”street name by a brokerage firm, your brokerage firm, as the record holder of your shares, is required to vote your shares according to your instructions. In order to vote your shares, you will need to follow the directions your brokerage firm provides you. Many brokers also offer the option of voting by the Internet or by telephone, instructions for which would be provided by your brokerage firm on your vote instruction form. Under the current rules of the New York Stock Exchange, or NYSE, and the NASDAQ Stock Market LLC or NASDAQ, if you do not give instructions to your brokerage firm, it will still be able to vote your shares with respect to only the “discretionary” matter discussed above, which is the ratification of the independent registered public accounting firm. If you do not provide instructions to your brokerage firm, it will not be able to vote on “non-discretionary”non-discretionary matters, which can result in a broker non-vote. A “broker non-vote”broker non-vote occurs when a bank, broker or other nominee holding shares for a beneficial owner does not vote on a particular proposal because it does not have discretionary voting power with respect to that item and has not received voting instructions from the beneficial owner. The election of the three (3)two directors nominated by the Board of Directors and named in this proxy statement the advisory approval of the Corporation’s named executive officers’ (“NEO” or “named executives”) compensation, and the advisory approval of the frequency for future stockholder advisory votes on the Corporation’s NEO compensation are “non-discretionary” mattersis a non-discretionary matter under the current rules of the NYSE.

NYSE and NASDAQ.PROPOSAL 1: ELECTION OF DIRECTORS

The Board of Directors is comprised of eight (8) directors, including seven (7) non-management directors, currently divided into three (3) classes with staggered terms. All directors have been determined to be independent by the Board of Directors except Mr. Mendez, who is employed by FCBIthe Corporation as President and Chief Executive Officer.

A. A. Modena served on FCBI’s Board of Directors during all of fiscal year 2010. The total number of directors serving in 2010 was nine (9), with eight (8) directors classified as non-management. However, Mr. Modena retired as a director, effective January 31, 2011. After careful consideration and discussion, and in full compliance with Article III of the Amended and Restated Bylaws of First Community Bancshares, Inc., effective April 29, 2008, the Board of Directors determined to reduce the number of directors to eight (8).

The class of directors nominated for re-election at the 20112013 Annual Meeting will be elected to serve until the 20142016 Annual Meeting. All nominees are currently serving on the Corporation’s Board of Directors. In the event any nominee is unable or declines to serve as a director at the time of the Annual Meeting, the proxies will be voted for an alternate nominee designated by the present Board of Directors to fill the vacancy. In the event that additional persons are nominated for election as directors, the proxy holders intend to vote all proxies received by them for the nominees listed below. All nominees named herein have consented to be named and to serve as directors if elected.

No director or executive officer of the Corporation is related to any other director or executive officer of the Corporation by blood, marriage or adoption, except for Mr. Stafford who is the father of Mr. Stafford, II.

A table of each director and nominee, including his age, the applicable director class, which is based upon the year in which his term of service expires, and title, is set forth below. A biography describing each director’s and nominee’s qualifications and business background is set forth below the table. Each nominee has consented to be named to, and to serve as, a director if elected. We doThe Corporation does not know of any reason why any nominee would be unable to serve as a director. If any nominee is unable to serve, the shares represented by all valid proxies will be voted for the election of such other person as the Board may nominate.

Members of the Corporation’s Board of Directors of First Community are expected to have the appropriate skills and characteristics necessary to function in the Corporation’s current operating environment and contribute to its future direction and strategies. These include legal, financial, management and other relevant skills. In addition, the Corporation looks to achieve a diversified Board, including members with varying experience, age, perspective, residence and background.

| | | | | Director of | | Class of |

| Name and Title | | Age | | Corporation Since | | Directors |

| Franklin P. Hall, Director Nominee | | 72 | | 2007 | | 2011 |

| Allen T. Hamner, Director | | 69 | | 1994 | | 2013 |

| Richard S. Johnson, Director | | 61 | | 2008 | | 2013 |

| I. Norris Kantor, Director | | 81 | | 1989 | | 2012 |

| John M. Mendez, President, CEO and Director | | 56 | | 1994 | | 2013 |

| Robert E. Perkinson, Jr., Director Nominee | | 63 | | 1994 | | 2011 |

| William P. Stafford, Director Nominee | | 77 | | 1989 | | 2011 |

| William P. Stafford, II, Chairman of the Board | | 47 | | 1994 | | 2012 |

| | | | | | | | | | | | |

Name and Title | | Age | | | Director of

Corporation

Since | | | Class of

Directors | |

W.C. Blankenship, Jr., Director | | | 62 | | | | 2013 | | | | 2015 | |

Franklin P. Hall, Director | | | 74 | | | | 2007 | | | | 2014 | |

Richard S. Johnson, Director Nominee | | | 63 | | | | 2008 | | | | 2013 | |

I. Norris Kantor, Director | | | 83 | | | | 1989 | | | | 2015 | |

John M. Mendez, President, CEO and Director Nominee | | | 58 | | | | 1994 | | | | 2013 | |

Robert E. Perkinson, Jr., Director | | | 65 | | | | 1994 | | | | 2014 | |

William P. Stafford, Director | | | 79 | | | | 1989 | | | | 2014 | |

William P. Stafford, II, Director | | | 49 | | | | 1994 | | | | 2015 | |

NOMINEES FOR THE CLASS OF 2014

Franklin P. Hall, Retired Commissioner, Virginia Department of Alcoholic Beverage Control, Senior Partner, Hall & Hall, PLC, Richmond,2016John M. Mendez, President and Chief Executive Officer, First Community Bancshares, Inc., Bluefield, Virginia.

Mr. Hall is a 1961 graduate of Lynchburg College, Lynchburg, Virginia,Mendez graduated from Concord University in 1978 with a BS degree in Mathematics and Business Administration. Mr. Hall also graduated from The American University, Washington, DC,Administration with a MBA degreeconcentration in 1964Accounting. Mr. Mendez earned his certification as a certified public accountant (“CPA”) in 1981 and The American University Law School with a Juris Doctor degreejoined First Community Bank in 1966.1985. Prior to serving as President and Chief Executive Officer (“CEO”) of the Corporation, Mr. Hall currently serves as Senior PartnerMendez served in the Hallpositions of Chief Financial Officer (“CFO”) and Hall Family Law Firm in Midlothian, Virginia where he has practiced law since 1969.Chief Administrative Officer. Mr. Mendez served as Audit Manager of Brown, Edwards & Company L.L.P. from 1978 to 1985. Mr. Mendez previously served on the Concord University Board of Governors and chaired its Finance

and Facilities Committees. He previously served as a delegate indirector of the Community Foundation of the Virginias, the West Virginia General Assembly from 1976 to 2009,Bankers Association, Virginia Bankers Association, and Minority Leader, Virginia House of Delegates from 2002 to 2008. He is a formerPrinceton Community Hospital where he served as Chairman of the Board of The CommonWealth Bank in Richmond, Virginia. Audit Committee.

Mr. Hall has served on the Greater Richmond Chamber of Commerce Foundation Board since 2004. He also has served as a commissioner for the Virginia Department of Alcoholic Beverage Control.

Mr. Hall’sMendez’ relevant experience qualifying him for service as a director includes: history as a wide rangepracticing CPA at a regional public accounting firm; external audit experience for a variety of businessbusinesses with emphasis in the banking sector while engaged in public accounting; familiarity with bank regulations and legal knowledge gained during an active forty-two (42) year law practice; his MBA degree; twenty-six (26) yearsbank and parent regulatory examination processes; writing, communicating and enforcing company, bank and subsidiary policies; success in negotiating and integrating acquired businesses in the execution of a variety of mergers and acquisitions; past service on a variety of boards of financial service organizations; thirty (30) years of overseeing the budget for the Commonwealth of Virginia;and audit committees including a 211-bed community hospital; long term service as senior member of the Joint Legislative Audit and Review Commission for the Virginia General Assembly; and service as Chair of the House Appropriations Subcommittee on Compensation.

Robert E. Perkinson, Jr., Former Vice President-Operations of MAPCO Coal and Alliance Coal Co., Inc., Bluefield, Virginia.

Mr. Perkinson received a BS degree in Civil Engineering – Construction Option in 1969 and a Professional degree in Soil Mechanics and Foundation Energy in 1970 from North Carolina State University. Prior to Mr. Perkinson’s employment with MAPCO Coal, he was employed as Vice President – Operations of South Atlantic Coal Co. and worked for J. A. Jones Construction in Charlotte, North Carolina. Upon leaving the employment of MAPCO Coal, Mr. Perkinson served as Acting Executive Director of the Bluefield Sanitary Board from 2006 to 2008 and Mayor of the City of Bluefield, West Virginia. Mr. Perkinson served as Chairman of the Board of Bluefield Regional Medical Center and currently serves as a member of the Board of Governors of Bluefield State College.

Mr. Perkinson’s relevant experience qualifying him for service as a director includes: previous service as a member of senior management for various companies in the coal industry; experience in municipal government, including service as executive directorCFO of a municipal sanitary board;publicly traded company; and service as board chairman for a non-profit regional medical center coupled with approximately twenty (20) years of bank board service.

William P. Stafford, President, Princeton Machinery Service, Inc., a machinery manufacturing and repair company, Princeton, West Virginia.

Mr. Stafford is a graduate of theUnited States Naval Ordnance Laboratory and U. S. Naval Gun Factory. He currently serves as the Vice Chairman of the Board of First Community Bank, N. A. He serves as President and Director of the H. P. and Anne S. Hunnicutt Foundation, Inc. and Melrose Enterprises, Ltd., and as a member of Stafford Farms, LLC. In addition to his current service as President of Princeton Machinery Service, Inc., a machinery manufacturing and repair company, Mr. Stafford previously served as its General Manager. Mr. Stafford also previously served as a member of the West Virginia Legislature, a director of the West Virginia Division of Natural Resources, a member of the Mercer County, West Virginia Economic Development Authority, and a member of the Mercer County, West Virginia Airport Authority.

Mr. Stafford’s relevant experience qualifying him for service as a director includes: owner and president of a successful machinery manufacturing and repair business; owner and president of several other successful businesses; director and president of a charitable foundation; extensive familiarity with the history and operation of the Corporation and its predecessor banks; participation and leadership in a wide variety of community and civic organizations; previous experienceoffices held with increasing management responsibilities during 28 years in elected state and local government offices; and more than twenty (20) yearsmanagement of board service for a publicly traded financial services company.

Your Board recommends a vote FOR the nominees set forth above.

CONTINUING INCUMBENT DIRECTORS

Allen T. Hamner, Professor Emeritus of Chemistry at West Virginia Wesleyan College, Buckhannon, West Virginia.

Mr. Hamner is a 1963 graduate of West Virginia Wesleyan College, Buckhannon, West Virginia and a 1969 graduate of Cornell University. Mr. Hamner joined the faculty of West Virginia Wesleyan College in 1969 and retired in 2008.

Mr. Hamner’s relevant experience qualifying him for service as a director includes: twenty-four (24) combined years of service on this Board and on a predecessor bank board and committees thereof; the ability to understand and discuss complex financial issues; eleven (11) years of service as a member of the Corporation’s Audit Committee; former treasurer of two (2) private companies; and valuable business acumen and experience as a general contractor in the development of retail spaces.

Richard S. Johnson, Chairman, President and Chief Executive Officer, The Wilton Companies, Richmond, Virginia.

Mr. Johnson earned a BS BA degree from the University of Richmond, Richmond, Virginia in 1973, with a concentrationconcentrations in Economics and Finance, and graduated with a MS degree from Virginia Commonwealth University, Richmond, Virginia in 1977, with a concentration in Real Estate and Urban Land Development. Mr. Johnson has been the President and Chief Executive Officer of The Wilton Companies, a real estate investment, development, brokerage and management group of companies, since 2002. He assumed the role of Chairman of The Wilton Companies in 2010. Prior to joining The Wilton Companies, Mr. Johnson served as President of Southern Financial Corp. of Virginia from 1985 to 2002 and Chairman of the Board of Southern Title Insurance Corporation from 1980 to 1985. Mr. Johnson currently serves as a director/trustee of First Community Bank, N. A., University of Richmond, Fidelity Group, LLC, and serves as the Chairman of the City of Richmond Economic Development Authority, and the Apartment Trust of America.Authority. Mr. Johnson also serves as Director Emeritus of Ducks Unlimited, Inc. and previously served as a director of the State Fair of Virginia, Children’s Museum of Richmond, Ducks Unlimited, Inc., and Ducks Unlimited Canada.

Mr. Johnson’s relevant experience qualifying him for service as a director includes: long-range planning, various aspects of mortgage underwriting, marketing and mortgage portfolio servicing; chairing the Economic Development Authority of the City of Richmond, Virginia; past service as a director and Finance Committee member of Ducks Unlimited, Inc. and Ducks Unlimited Canada; and state and national offices with Ducks Unlimited, Inc., including Assistant Treasurer and member of the Finance and Audit Subcommittee.

Subcommittee; and previous service as a director and Audit Committee member of the Apartment Trust of America.Your Board recommends a voteFOR the nominees set forth above.

CONTINUING INCUMBENT DIRECTORS

W.C. Blankenship, Jr., State Farm Insurance Agent, Tazewell, Virginia.

Mr. Blankenship received his BS degree in 1972 from Appalachian State University and has served as a successful insurance agent for State Farm since 1976. Mr. Blankenship joined First Community Bank in July of 1996 following its acquisition of Citizens Bank of Tazewell, Inc. He was appointed to Citizens Bank’s Board of Directors during its formation in 1981 and was instrumental in the establishment of that bank, eventually serving as Chairman of the Board from 1984 through its acquisition by First Community Bank.

Mr. Blankenship’s relevant experience qualifying him for service as a director includes: more than 35 years of expertise and knowledge in insurance products and services and more than 30 years of bank board service.

Franklin P. Hall, Retired Commissioner, Virginia Department of Alcoholic Beverage Control, Senior Partner, Hall & Hall, PLC, Richmond, Virginia.

Mr. Hall is a 1961 graduate of Lynchburg College, Lynchburg, Virginia, with a BS degree in Mathematics and Business Administration. Mr. Hall also graduated from The American University, Washington, D.C., with a MBA degree in 1964 and The American University Law School with a Juris Doctor degree in 1966. Mr. Hall currently serves as Senior Partner in Hall & Hall, PLC in Midlothian, Virginia where he has practiced law since 1969. He served as a delegate in the Virginia General Assembly from 1976 to 2009, and Minority Leader, Virginia House of Delegates from 2002 to 2008. He is a former Chairman of the Board of The CommonWealth Bank in Richmond, Virginia. Mr. Hall has served on the Greater Richmond Chamber of Commerce Foundation Board since 2004. He also has served as a commissioner for the Virginia Department of Alcoholic Beverage Control.

Mr. Hall’s relevant experience qualifying him for service as a director includes: a wide range of business and legal knowledge gained during an active 44 year law practice; his MBA degree; 28 years of service on boards of financial service organizations; 30 years of overseeing the budget for the Commonwealth of Virginia; service as senior member of the Joint Legislative Audit and Review Commission for the Virginia General Assembly; and service as Chair of the House Appropriations Subcommittee on Compensation.

I. Norris Kantor, Of Counsel, Katz, Kantor, Stonestreet & Perkins,Buckner, PLLC, Princeton and Bluefield, West Virginia.

Mr. Kantor received a BA degree in 1953 from the Virginia Military Institute and received a Juris Doctor degree in 1956 from the College of Law at West Virginia University. Mr. Kantor has practiced law for more than fifty (50)50 years and is currently Of Counsel with the law firm of Katz, Kantor, Stonestreet & Perkins, Attorneys-at-Law.Buckner, PLLC. He served as a Judge Advocate USAF from 1956 to 1958. Mr. Kantor is a director of Mercer Realty Inc., a real estate management company, and Gomolco, Inc., a real estate holding company. Mr. Kantor currently serves in the following leadership capacities: Board member of Bluefield State College Foundation, Bluefield State College Board of Governors, New River Parkway Authority, and the Bluefield Development Authority; Board member and Secretary of Bluefield State College Research and Development Corp.; and Board member and President of the Downtown Health and Wellness Center, Inc.

Mr. Kantor is also a former member and Chair of the West Virginia Ethics Commission.Mr. Kantor’s relevant experience qualifying him for service as a director includes: a wide range of legal and business experience gained during his more than fifty (50)50 years as a practicing attorney; his legal work in issuing numerous utility bonds and refunding of utility bond issues; his ability to understand complex business, legal and financial topics; and twenty-one (21)23 years of service as a board member of financial service organizations.

John M. Mendez, PresidentRobert E. Perkinson, Jr., Former Vice President-Operations of MAPCO Coal and Chief Executive Officer, First Community Bancshares,Alliance Coal Co., Inc., Bluefield, Virginia.

Mr. Mendez attended Marshall University from 1973 to 1975 and graduated from Concord University in 1978 withPerkinson received a BS degree in Business Administration withCivil Engineering—Construction Option in 1969 and a concentrationprofessional degree in Accounting. Mr. Mendez earned his certification as a certified public accountant (“CPA”)Soil Mechanics and Foundation Energy in 1981 and joined First Community Bank, N. A. in 1985.1970 from North Carolina State University. Prior to servingMr. Perkinson’s employment with MAPCO Coal, he was employed as PresidentVice President—Operations of South Atlantic Coal Co. and Chief Executive Officer (“CEO”) worked for J. A. Jones Construction in Charlotte, North Carolina. Upon leaving the employment of First Community Bancshares, Inc.,MAPCO Coal, Mr. Mendez served in the positions of Chief Financial Officer (“CFO”) and Chief Administrative Officer. Mr. MendezPerkinson served as Audit Manager of Brown, Edwards & Company L.L.P. from 1978 to 1985. Mr. Mendez serves on the Concord University Board of Governors and chairs its Finance and Facilities Committees. He previously served as a director for the Community FoundationActing Executive Director of the Virginias,Bluefield Sanitary Board from 2006 to 2008 and Mayor of the City of Bluefield, West Virginia Bankers Association, Virginia Bankers Association, and Princeton Community Hospital where heVirginia. Mr. Perkinson served as Chairman of the Audit Committee.

Board of Bluefield Regional Medical Center and currently serves as a member of the Board of Governors of Bluefield State College.Mr. Mendez’Perkinson’s relevant experience qualifying him for service as a director includes: historyprevious service as a practicing CPA atmember of senior management for various companies in the coal industry; experience in municipal government,

including service as executive director of a regional public accounting firm; external audit experiencemunicipal sanitary board; and service as board chairman for a non-profit regional medical center coupled with approximately 20 years of bank board service.

William P. Stafford, President, Princeton Machinery Service, Inc., Princeton, West Virginia.

Mr. Stafford is a graduate of the United States Naval Ordnance Laboratory and U. S. Naval Gun Factory. He currently serves as the Vice Chairman of the Board of First Community Bank. He serves as President and Director of the H. P. and Anne S. Hunnicutt Foundation, Inc. and Melrose Enterprises, Ltd., and as a member of Stafford Farms, LLC. Mr. Stafford serves as President of Princeton Machinery Service, Inc., a machinery manufacturing and repair company, which is a position he has held since the 1950s. Mr. Stafford previously served as its General Manager. Mr. Stafford also previously served as a member of the West Virginia Legislature, a director of the West Virginia Division of Natural Resources, a member of the Mercer County, West Virginia Economic Development Authority, and a member of the Mercer County, West Virginia Airport Authority.

Mr. Stafford’s relevant experience qualifying him for service as a director includes: owner and president of a successful machinery manufacturing and repair business; owner and president of several other successful businesses; director and president of a charitable foundation; extensive familiarity with the history and operation of the Corporation and its predecessor banks; participation and leadership in a wide variety of businesses with emphasiscommunity and civic organizations; previous experience in elected state and local government offices; and more than 20 years of board service for the banking sector while engaged in public accounting; familiarity with bank regulations and bank and parent regulatory examination process; writing, communicating and enforcing company, bank and subsidiary policies; success in negotiating and integrating acquired businesses in the execution of a variety of mergers and acquisitions; past service on a variety of boards and audit committees including a 211-bed community hospital; long term service as CFO of a publicly traded company; and the variety of offices held with increasing management responsibilities during twenty-six (26) years in management of a publicly traded financial services company.

Corporation.William P. Stafford, II, Attorney, Brewster, Morhous, Cameron, Caruth, Moore, Kersey & Stafford, PLLC, Bluefield, West Virginia.

Mr. Stafford is a graduate of Virginia Polytechnic Institute and State University, Blacksburg, Virginia, and holds a BS degree in Mechanical Engineering. He received his Juris Doctor,cum laude, from the Washington & Lee University School of Law, Lexington, Virginia. Mr. Stafford practices as a member of his firm primarily in the areas of commercial transactions, banking, creditor’s rights, creditor bankruptcy, and trusts and estates. He currently serves as Chairman of the Board of First Community Bancshares, Inc.the Corporation. Mr. Stafford serves as a director and Corporate Secretary of the H. P. and Anne S. Hunnicutt Foundation, Inc., Princeton Machinery Service, Inc., and Melrose Enterprises, Ltd. He is a member of Stafford Farms, LLC, Vermillion Development, LLC, and Walnut Hill, LLC, which include real estate and agricultural holdings. Mr. Stafford is a partner in Legal Realty, A Partnership. Mr. Stafford previously served as a member of the West Virginia Infrastructure and Jobs Development Council. Mr. Stafford previously served as a council member and Mayor of the City of Princeton, West Virginia. Mr. Stafford has served, and continues to serve, on numerous civic and community service boards and commissions.

Mr. Stafford’s relevant experience qualifying him for service as a director includes: a broad range of regulatory, business, legal and banking related issues encountered in the practice of law; extensive state and municipal government service; extensive civic and community service; and more than fifteen (15)15 years of boardBoard service for the Corporation.

Director Qualifications and Experience. The following table identifies the experience, qualifications, attributes and skills that the Board considered in making its decision to appoint and nominate directors to ourthe Corporation’s Board. This information supplements the biographical information provided above. The vertical axis displays the primary factors reviewed by the Governance and Nominating Committee in evaluating a Board candidate.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Blankenship, Jr. | | | Hall | | Hamner | Kantor | | Kantor | | Johnson | | | Mendez | | | Perkinson, Jr. | | | Stafford | | | Stafford, II |

Experience, Qualifications, Skill or Attribute | | | | | | | | | | | | | | | | |

| | | | | | | | |

Experience, Qualifications, Skills or Attributes | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Professional standing in chosen field | | | X | | X | | X | | X | | X | | X | | X | | X |

Expertise in financial services or related industry | | X | | X | | X | | X | | X | | X | | X | | X |

Audit Committee Financial Expert (actual or potential) | | | | X | | | | X | | X | | | | | | |

Civic and community involvement | | X | | X | | X | | X | | X | | X | | X | | X |

Other public company experience (current or past) | | | | | | | | | | | | | | | | |

Leadership and team building skills | | X | | X | | X | | X | | X | | X | | X | | X |

Diversity of experience, professions, skills, geographic representation and backgrounds | | X | | X | | X | | X | | X | | X | | X | | X |

Specific skills/knowledge: | | | | | | | | | | | | | | | | |

- finance | | X | | X | | X | | X | | X | | X | | X | | X |

- technology | | | | X | | | | X | | X | | X | | | | X |

- marketing | | | | | | | | X | | X | | | | | | |

- public affairsExpertise in financial services or related industry | | X | | X | | X | | X | | X | | X | | X | | X |

- HR | | X | | | | X | | X | | X | | X | | | | X |

- governance | | | X | | X | | X | | X | | X | | | | X | |

Audit Committee Financial Expert (actual or potential) | | | | | | | | | | | | | | | X | | | | X | | | | | | | | | | | | | |

Civic and community involvement | | | X | | | | X | | | | X | | | | X | | | | X | | | | X | | | | X | | | | X | |

Other public company experience (current or past) | | | | | | | | | | | | | | | X | | | | | | | | | | | | | | | | | |

Leadership and team building skills | | | X | | | | X | | | | X | | | | X | | | | X | | | | X | | | | X | | | | X | |

Diversity of experience, professions, skills, geographic representation and backgrounds | | | X | | | | X | | | | X | | | | X | | | | X | | | | X | | | | X | | | | X | |

Specific skills/knowledge: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

- finance | | | X | | | | X | | | | X | | | | X | | | | X | | | | X | | | | X | | | | X | |

- technology | | | | | | | | | | | | | | | | | | | X | | | | X | | | | | | | | X | |

- marketing | | | X | | | | | | | | | | | | X | | | | X | | | | | | | | | | | | | |

- public affairs | | | X | | | | X | | | | X | | | | X | | | | X | | | | X | | | | X | | | | X | |

- HR | | | X | | | | X | | | | X | | | | X | | | | X | | | | X | | | | | | | | X | |

- governance | | | X | | | | X | | | | X | | | | X | | | | X | | | | X | | | | X | | | | X | |

NON-DIRECTOR EXECUTIVE OFFICERS

Executive officers who are not directors of the Corporation, including their title, age and date they became an officer of the Corporation are set forth in the chart below, which is followed by a brief biography describing each named executive’s business experience.

| | | | | Executive of |

| Name and Title | | Age | | Corporation Since |

| David. D. Brown, Chief Financial Officer of Corporation and First Community Bank, N. A. | | 36 | | 2006 |

| Robert L. Buzzo, Vice President and Secretary of Corporation, President and Director of First Community Bank, N. A. | | 61 | | 2000 |

| E. Stephen Lilly, Chief Operating Officer of Corporation, Executive Vice President, Chief Operating Officer and Chief Information Officer of First Community Bank, N. A. | | 52 | | 2000 |

| Robert L. Schumacher, General Counsel of Corporation, Senior Vice President, General Counsel and Secretary of First Community Bank, N. A. | | 60 | | 2001 |

| | | | | | | | |

Name and Title | | Age | | | Executive of

Corporation Since | |

David D. Brown, Chief Financial Officer of Corporation and First Community Bank | | | 38 | | | | 2006 | |

Robert L. Buzzo, Vice President and Secretary of Corporation, President and Director of First Community Bank | | | 63 | | | | 2000 | |

E. Stephen Lilly, Chief Operating Officer of Corporation, Executive Vice President and Chief Operating Officer of First Community Bank | | | 54 | | | | 2000 | |

Robert L. Schumacher, General Counsel of Corporation, Senior Vice President, General Counsel and Secretary of First Community Bank | | | 62 | | | | 2001 | |

David D. Brown, Chief Financial Officer of the Corporation and First Community Bank, N. A., a wholly-owned subsidiary of the Corporation.

Bank.Mr. Brown has been CFO of the Corporation and First Community Bank N. A. since May 2006. Mr. Brown served as Financial Reporting Coordinator of the Corporation from April 2005 to May 2006. Prior to joining the Corporation, Mr. Brown was a corporate auditorCorporate Auditor and Audit Manager of United Bankshares, Inc. from September 1999 to April 2005. Mr. Brown also practiced in the field of public accounting from 1997 to 1999 where he practiced tax, accounting, and auditing across a variety of industries. Mr. Brown is a CPA and holds a MPA degree from West Virginia University.

Robert L. Buzzo,Vice President and Secretary of the Corporation, President and Director of First Community Bank, N. A., a wholly-owned subsidiary of the Corporation.Bank.

Mr. Buzzo has been Vice President and Secretary of the Corporation and President and a director of First Community Bank N. A. since June 2000. From October 1994 until June 2000, Mr. Buzzo was the Chief Executive Officer of First Community Bank – Bank—Bluefield, a division of First Community Bank, N. A.Bank. Prior to 1994, Mr. Buzzo held other leadership positions since joining the Corporation in 1973.

E. Stephen Lilly, Chief Operating Officer of the Corporation, Executive Vice President Chief Operating Officer, and Chief InformationOperating Officer of First Community Bank, N. A., a wholly-owned subsidiary of the Corporation.Bank.

Mr. Lilly has been Chief Operating Officer (“COO”) of the Corporation and First Community Bank N. A. since June 2000. On January 25, 2011, Mr. Lilly was promoted to Chief Information Officer of First Community Bank, N. A. Mr. Lilly has been employed by the Corporation since 1997. Mr. Lilly has also served in a variety of banking positions and capacities with the Corporation and other banking organizations where he supervised and managed a number of operational elements, implemented new technologies and successfully migrated and consolidated bank operations and data. Mr. Lilly also has significant experience in process engineering and customer service management.

Robert L. Schumacher, General Counsel of the Corporation and Senior Vice President, General Counsel and Secretary of First Community Bank, N. A., a wholly-owned subsidiary of the Corporation.

Bank.Mr. Schumacher has served as General Counsel of the Corporation and First Community Bank N. A. since 2005. He has also served as Senior Vice President and Secretary of First Community Bank N. A. since 2001. Prior to his current positions, Mr. Schumacher served as the Corporation’s CFO and Senior Vice President – President—Finance from 2001 until 2005. In addition, Mr. Schumacher has led First Community Bank, N. A.’sBank’s Trust Department and Financial Services Division

in the capacity of Senior Vice President and Senior Trust Officer. Prior to joining the Corporation in 1983, Mr. Schumacher engaged in the private practice of law in Princeton, West Virginia. Mr. Schumacher is a CPA, a Certified Financial Planner, is licensed to practice law and holds a Juris Doctor degree from West Virginia University.

Corporate Governance Guidelines. The Board of Directors’ Governance and Nominating Committee has enacted guidelines to determine director independence and qualifications for directors. The Governance and Nominating Committee Charter is published at the Corporation’s website under the “Governance Documents” tab of the “Corporate Profile” link at www.fcbinc.com. This section of the website makes available all of First Community’s governance materials, including various Board committee charters, which are available in print to any stockholder upon request. The Board regularly reviews corporate governance developments and considers modifications to its governance charter to clarify and augment the Board’s processes, including those relating to risk oversight.

The Board’s Role in Risk Oversight. We believeThe Corporation believes that each member of ourthe Board of Directors in his fiduciary capacity has a responsibility to monitor and manage risks faced by the Corporation. At a minimum, this requires the members of ourthe Board of Directors to be actively engaged in boardBoard discussions, review materials provided to them, and know when it is appropriate to request further information from management and/or engage the assistance of outside advisors. Furthermore, because the banking industry is highly regulated, certain risks to the Corporation are monitored by the Board of Directors and the Audit Committee through its review of the Corporation’s compliance with regulations set forth by its regulatory authorities, including recommendations contained in regulatory examinations.

Because we believethe Corporation believes risk oversight is a responsibility for each member of the Board of Directors, we doit does not concentrate the Board’s responsibility for risk oversight in a single committee. Instead, each of ourthe committees concentrates on specific risks for which it has an expertise, and each committee is required to regularly report to the Board of Directors on its findings. For example, the Audit Committee regularly monitors the Corporation’s exposure to certain investment risks, such as the effect of interest rate or liquidity changes, the Corporation’s exposure to certain reputational risks by establishing and evaluating the effectiveness of First Communityits programs to report and monitor fraud and by monitoring the Corporation’s internal controls over financial reporting. OurThe Corporation’s Compensation and Retirement Committee’s role in monitoringCommittee monitors risks associated with the risks related to ourdesign and administration of the Corporation’s compensation structure isprograms as discussed in further detail below.

Director Independence. First Community currently has seven (7) independent directors outin the Compensation Discussion and Analysis beginning on page 12.The Board’s role in risk oversight of eight (8).the Corporation is consistent with the Corporation’s leadership structure, with the CEO and other members of senior management having responsibility for assessing and managing the Corporation’s risk exposure, and the Board and its committees providing oversight in connection with those efforts. The Board has satisfied,of Directors annually reviews the relationships of each of its members with the Corporation to determine whether each director is independent. This determination is based on both subjective and expectsobjective criteria developed by the NASDAQ listing standards and the SEC rules.

Independence of Directors

The Board of Directors reviewed the directors’ responses to continuea questionnaire asking about their relationships with the Corporation (and those of their immediate family members) and other potential conflicts of interest, as well as information provided by management related to satisfy, its objective that at least a majoritytransactions, relationships, or arrangements between the Corporation and the directors or parties related to the directors in order to determine the independence of the current members of the Board should consist of independent directors. For a director to be considered independent,Directors and the nominees for election as directors of the Corporation.

Based on the subjective and objective criteria developed by the NASDAQ listing standards and the SEC rules, the Board must determineof Directors determined that the director does not have any direct or indirect material relationship with First Community. The Board has established guidelines to assist it in determining director independence (see Appendix A to this proxy statement), which conform to the independence requirementsfollowing nominees and current members of the NASDAQ Stock Market listing rules. In addition to applying these guidelines, the Board will consider all relevant factsof Directors are independent: W. C. Blankenship, Jr., Franklin P. Hall, Richard S. Johnson, I. Norris Kantor, Robert E. Perkinson, Jr., William P. Stafford and circumstances in makingWilliam P. Stafford, II. John M. Mendez is not independent because he is an independence determination.

In the courseexecutive officer of the Board’s determination regarding independence, it considers any transactions, relationships and arrangements as required by the Corporation’s independence guidelines. In addition, with respect to all directors, the Board considered the amount of First Community’s discretionary charitable contributions to charitable organizations where any of the directors serve as an officer, director or trustee, and determined that First Community’s contributions to each of the charitable organizations constituted less than the greater of $200,000 or five percent (5%) of the charitable organization’s annual consolidated gross revenues during the applicable organization’s last completed fiscal year.

AllCorporation.The NASDAQ listing standards contain additional requirements for members of the Audit Committee and the Compensation and Retirement Committee. All of the directors serving on each of these committees are independent under the additional requirements applicable to such committees.

The Board considered the following relationships in evaluating the independence of the Corporation’s Directors and determined that none of the relationships constitute a material relationship with the Corporation and each of the relationships satisfied the standards for independence:

Director Stafford, II serves as a partner of a law firm, which, similar to other firms in other localities, regularly provides legal services to the Corporation and its affiliates. The law firm provided legal services and received payments from the Corporation for such services during 2012. These payments did not exceed the greater of 5% of the law firm’s consolidated revenues for 2012 or $200,000, and therefore, the relationship satisfied the standards for independence.

Director Johnson serves as Chairman, President and CEO of The Wilton Companies. The Wilton Companies is comprised of three entities under common management. During 2012, the Corporation and its affiliates leased two offices from two of these entities, The Wilton Companies, Inc. and The Wilton Companies, LLC. Director Johnson holds an equity ownership in these two entities. The combined annual lease payments did not exceed the greater of 5% of The Wilton Companies’ and its subsidiaries’ consolidated revenues for 2012 or $200,000, and therefore, the relationship satisfied the standards for independence.

Board Leadership Structure. The Corporation separates the roles of CEO and Chairman of the Board in recognition of the differences between the two roles. The CEO is responsible for setting the strategic direction for the Corporation and the day-to-day leadership and performance of the Corporation, while the Chairman of the Board provides guidance to the CEO and sets the agenda for Board meetings and presides over meetings of the full Board.

The separation of these roles is appropriate for the Corporation because the separation results in a more effective monitoring and objective evaluation of the CEO’s performance. In addition, the CEO is unable to control the Board’s agenda and information flow that reduces the likelihood that the CEO will abuse his power. The Board also believes that directors will be more likely to challenge the CEO if the Chairman of the Board is not the CEO.

Standards of Conduct. All directors, officers and employees of the Corporation must act ethically at all times and in accordance with the policies comprising the Corporation’s Standards of Conduct (“Code”), which is available at the Corporation’s website www.fcbinc.com and available in print to any stockholder upon request. Only the Board of Directors may waive a provision of the Code and only for just cause in an instance where the underlying ethical objective will not be violated. No waivers were granted to any director or officer during 2012. Amendments to the Code will be published on the Corporation’s website, as required by SEC rules. If an actual or potential conflict of interest arises for a director, the director must promptly inform the Board.

Communicating Concerns to Directors. The Audit Committee and the non-management directors have established procedures to enable any employee who has a concern about the Corporation’s conduct, policies, accounting, internal accounting controls or auditing matters, to communicate that concern directly to the Board through an e-mail or written notification directed to the Chairman of the Audit Committee. Such communications may be confidential or anonymous. A notification explaining how to submit any such communication is provided to all employees at each location of the Corporation and its affiliated businesses and is provided to employees in the employee handbook. The status of any outstanding concern is reported to the non-management directors of the Board periodically by the Chairman of the Audit Committee.

Stockholder Communications. Stockholders may communicate with all or any member of the Board of Directors by addressing correspondence to the Board of Directors or to the individual director and addressing such communication to Robert L. Buzzo, Secretary, First Community Bancshares, Inc., P. O. Box 989, Bluefield, Virginia 24605-0989. All communications so addressed will be forwarded to the Chairman of the Board of Directors (in case of correspondence addressed to the Board of Directors) or to the individual director, without exception.

The Board of Directors and Board Meetings

The Board of Directors held ten regular meetings and two joint meetings with the First Community Bank Board in 2012. No member attended fewer than 75% of the Board meetings and committee meetings on which the member sits. Each director is expected to devote sufficient time, energy and attention to ensure diligent performance of the director’s duties and to attend all regularly scheduled Board, committee, and stockholder meetings. It is the Board’s policy that the directors should attend the Annual Meeting absent exceptional circumstances. All current directors attended the 2012 Annual Meeting.

Board Committees

The Board of Directors has adopted written charters for three of its four standing committees: the Audit Committee, the Compensation and Retirement Committee (the “CRC”), and the Governance and Nominating Committee. A current copy of each of the committee charters is available for review and print on the Corporation’s website at www.fcbinc.com.

Audit Committee. The members of the Audit Committee are Directors Perkinson, who chairs the Committee, Hall and Johnson. The Board has determined that Mr. Johnson is the Audit Committee financial expert. The Audit Committee is primarily concerned with the integrity of the Corporation’s financial statements, the independence and qualifications of the independent registered public accounting firm and the performance of the Corporation’s internal audit function and independent registered public accounting firm. Its duties include: (1) selection and oversight of the independent registered public accounting firm; (2) review of the scope of the audit to be conducted by the independent registered public accounting firm, as well as the results of their audit; (3) oversight of the Corporation’s financial reporting activities, including the annual report, and the accounting standards and principles followed; (4) discussion with management of its risk assessment and management policies, including risk relating to the financial statements and financial reporting process and the steps taken by management to monitor and mitigate such risks; (5) approval of audit and non-audit services provided to the Corporation by the independent registered public accounting firm; (6) review of the organization and scope of the Corporation’s internal audit function and its disclosure and internal controls; and (7) reviews, approves and ratifies transactions with related persons. The Audit Committee held 12 meetings during 2012. The Audit Committee’s report is on page 31.

Executive Committee. The members of the Executive Committee are Directors Stafford II, who chairs the Committee, Hall, Johnson, Kantor, Mendez, Perkinson and Stafford. Except for Mr. Mendez, each member of the Executive Committee is independent. The Executive Committee did not meet in 2012. The Committee, subject to the supervision and control of the Board of Directors, has been delegated substantially all of the powers of the Board to act between meetings of the Board, except for certain matters reserved to the full Board by law.

Compensation and Retirement Committee. The members of the CRC are Directors Stafford, II, who chairs the Committee, Johnson, and Stafford. The CRC’s primary duties and responsibilities are to: (1) review, evaluate and determine annually the executive officers’ and directors’ compensation and the corporate goals and objectives relevant thereto, and to evaluate the executive officers’ performance in light of such goals and objectives; (2) review and evaluate all compensation decisions otherwise made by the CEO; (3) review, evaluate and determine all equity-based incentive awards; (4) review organizational systems and plans relating to management development and succession planning; and (5) review and discuss with management the proxy statement’s Compensation Discussion and Analysis and produce the CRC report. The CRC does not delegate any of its responsibilities to subcommittees.

The CEO of the Corporation provides the CRC with a performance assessment and compensation recommendation for each of the other executive officers of the Corporation. The CRC has the authority to retain or obtain the advice of any advisors as the CRC deems necessary in the performance of its duties. In 2012, the CRC directly engaged Mathews, Young—Management Consulting (“Mathews Young”) to provide compensation

analysis and advice regarding incentive compensation for employees of the Corporation. At the request of the CRC, Mathews Young: (i) developed a peer group analysis for the CRC’s review of compensation levels; (ii) formulated recommendations for long range performance compensation; and (iii) developed recommendations for an incentive program for the special assets department.Mathews Young was not retained to provide any other services to the Corporation. The CRC is still in the process of reviewing the Mathews Young recommendations and anticipates implementing some or all of them in 2013. Retention of Mathews Young by the CRC raised no conflicts of interest. The CRC held five meetings in 2012. The CRC’s report is on page 20. In 2012, the Board of Directors voted to amend the CRC Charter, which may be found on the Corporation’s website.

Compensation and Retirement Committee Interlocks and Insider Participation. None of the members of the CRC are or were formerly officers or employees of the Corporation or any of its subsidiaries. Finally, none of the executive officers of the Corporation served on any compensation committee or any board of directors of another company, of which any of the Corporation’s Board members was also an executive officer.

Governance and Nominating Committee. The members of the Governance and Nominating Committee must be independent directors as defined by NASDAQ. Membersare Directors Stafford, II, who chairs the Committee, Kantor, and Stafford. The Committee’s responsibilities include the selection of director nominees for Board service and the development and review of governance guidelines. The Committee also: (1) oversees the annual self-evaluations of the AuditBoard, as well as director performance and Board dynamics; and (2) makes recommendations to the Board concerning the structure and membership of the Board committees. This Committee also must satisfy a separate Securities and Exchange Commission (“SEC”) independence requirement, which provides that they may not accept directly or indirectly any consulting, advisory or other compensatory fee from First Community or its subsidiaries other than their directors’ compensation.

held two meetings in 2012.Director Candidates, Qualifications and Diversity. In considering whether to recommend any candidate for inclusion in the Board’s slate of recommended director nominees, including candidates recommended by stockholders, the Governance and Nominating Committee will considerconsiders a number of criteria, including, without limitation, the candidate’s integrity, business acumen, age, experience, commitment, diligence, conflicts of interest and the ability to act in the interests of all stockholders. The Governance and Nominating Committee believes diversity should be considered in the director identification and nomination process. The Governance and Nominating Committee seeks nominees with a broad diversity of experience, professions, skills, geographic representation and backgrounds. The Committee does not assign specific weights to particular criteria and no particular criterion is necessarily applicable to all prospective nominees. The Corporation believes that the backgrounds and qualifications of the directors, considered as a group, should provide a significant composite mix of experience, knowledge and abilities that will allow the Board to fulfill its responsibilities. Nominees are not discriminated against on the basis of race, religion, national origin, sexual orientation, disability or any other basis prescribed by law.

Board Leadership Structure. We separate the roles of CEO and Chairman of the Board in recognition of the differences between the two (2) roles. The CEO is responsible for setting the strategic direction for the Corporation and the day-to-day leadership and performance of the Corporation, while the Chairman of the Board provides guidance to the CEO and sets the agenda for Board meetings and presides over meetings of the full Board.

Standards of Conduct. All directors, officers and employees of First Community must act ethically at all times and in accordance with the policies comprising First Community’s Standards of Conduct (“Code”), which is published at First Community’s website www.fcbinc.com and available in print to any stockholder upon request. A waiver of any standard can only be considered by the Board of Directors and may be granted only for just cause in an instance where the underlying ethical objective will not be violated. No waivers were granted to any director or officer during 2010. Amendments to the Code will be published on the Corporation’s website, as required by SEC rules. If an actual or potential conflict of interest arises for a director, the director must promptly inform the Board.

Communicating Concerns to Directors. The Audit Committee and the non-management directors have established procedures to enable any employee who has a concern about First Community’s conduct, policies, accounting, internal accounting controls or auditing matters, to communicate that concern directly to the Board through an email or written notification directed to the Chairman of the Audit Committee. Such communications may be confidential or anonymous. A notification explaining how to submit any such communications is provided to all employees at each location of the Corporation and its affiliated businesses and is provided to employees in the employee handbook. The status of any outstanding concern is reported to the non-management directors of the Board periodically by the Chairman of the Audit Committee.

Stockholder Communications. Stockholders may communicate with all or any member of the Board of Directors by addressing correspondence to the “Board of Directors” or to the individual director and addressing such communication to Robert L. Buzzo, Secretary, First Community Bancshares, Inc., P. O. Box 989, Bluefield, Virginia 24605-0989. All communications so addressed will be forwarded to the Chairman of the Board of Directors (in case of correspondence addressed to the “Board of Directors”) or to the individual director without exception.

The Board of Directors and Board Meetings

The Board held nine (9) regular meetings and three (3) special meetings in 2010. No member attended fewer than seventy-five percent (75%) of the Board meetings and committee meetings on which the member sits. Each director is expected to devote sufficient time, energy and attention to ensure diligent performance of the director’s duties and to attend all regularly scheduled Board, committee, and stockholder meetings. It is the Board’s policy that the directors should attend our Annual Meeting absent exceptional circumstances. All current directors attended the 2010 Annual Meeting.

Board Committees

The Board of Directors has adopted written charters for its four (4) standing committees: the Audit Committee, the Executive Committee, the Compensation and Retirement Committee (the “CRC”), and the Governance and Nominating Committee. Except for the Executive Committee Charter, a current copy of each of the committee charters is available for review and print on our website at www.fcbinc.com.

Audit Committee. The members of the Audit Committee are Directors Perkinson, who chairs the Committee, Hall, Hamner and Johnson. The Board has determined that Mr. Johnson is the “Audit Committee Financial Expert”. The Audit Committee is primarily concerned with the integrity of the Corporation’s financial statements, the Corporation’s compliance with legal and regulatory requirements, the independence and qualifications of the independent registered public accounting firm and the performance of the Corporation’s internal audit function and independent registered public accounting firm. Its duties include: (1) selection and oversight of the independent registered public accounting firm; (2) review of the scope of the audit to be conducted by them, as well as the results of their audit; (3) oversight of our financial reporting activities, including our annual report, and the accounting standards and principles followed; (4) discussion with management of its risk assessment and management policies, including risk relating to the financial statements and financial reporting process and key credit risks, liquidity risks, market risks and the steps taken by management to monitor and mitigate such risks; (5) approval of audit and non-audit services provided to the Corporation by the independent registered public accounting firm; (6) review of the organization and scope of our internal audit function and our disclosure and internal controls; and (7) oversight of the Corporation’s compliance program. The Audit Committee held eleven (11) meetings during 2010. The Committee’s report is on page 36. On February 22, 2011, the Board of Directors voted to amend the Audit Committee Charter, which is included as Appendix B to this proxy statement.

Executive Committee. The members of the Executive Committee are Directors Stafford II, who chairs the Committee, Hall, Hamner, Johnson, Kantor, Mendez, Perkinson and Stafford. Except for Mr. Mendez, each member of the Executive Committee is independent. The Executive Committee held one (1) meeting during 2010. The Committee, subject to the supervision and control of the Board of Directors, has been delegated substantially all of the powers of the Board to act between meetings of the Board, except for certain matters reserved to the full Board by law.

Compensation and Retirement Committee. The members of the CRC are Directors Stafford, II, who chairs the Committee, Hamner, and Johnson. This Committee’s primary responsibilities include: (1) establishing, reviewing and providing recommendations to the full Board regarding CEO compensation and reviewing and overseeing other senior executive compensation; (2) monitoring management resources, structure, succession planning, development and selection processes and the performance of key executives; (3) reviewing incentive compensation arrangements to ensure that incentive pay does not encourage unnecessary risk; (4) reviewing and discussing, at least annually, the relationship between risk management policies and practices, corporate strategy and senior executive compensation; and (5) reviewing director compensation and benefits. This Committee also administers all incentive and stock option plans for the benefit of such officers and directors eligible to participate in such plans. The CRC held two (2) meetings in 2010. The Committee’s report is on page 22.

Compensation and Retirement Committee Interlocks and Insider Participation. None of the members of the CRC are or were formerly officers or employees of our Corporation or any of its subsidiaries; however, one (1) member does have a relationship with us that is disclosable as a “Related-Person Transaction” as defined by the SEC. Director Stafford, II serves as a partner of a law firm, which, similar to other firms in other localities, regularly performs legal services each fiscal year for the Corporation and its affiliates. First Community Bank, N. A. paid Mr. Stafford’s law firm $128,332 in 2010. The business structure of Mr. Stafford’s law firm is that of a partnership, whereby the partners share equally in profits and losses. Finally, none of our executive officers served on any compensation committee or any board of directors of another company, of which any of our Board members was also an executive officer.

Governance and Nominating Committee. The members of the Governance and Nominating Committee are Directors Stafford, II, who chairs the Committee, Hamner and Kantor. The Committee’s responsibilities include the selection of director nominees for Board service and the development and review of governance guidelines. The Committee also: (1) oversees the annual self-evaluations of the Board, as well as director performance and Board dynamics; (2) makes recommendations to the Board concerning the structure and membership of the Board committees; and (3) reviews, approves and ratifies transactions with related persons required to be disclosed under SEC rules. This Committee held two (2) meetings in 2010.

The Committee will consider all stockholder recommendations for candidates for the Board, which should be sent to the Governance and Nominating Committee, c/o Robert L. Buzzo, Vice President and Secretary of First Community Bancshares, Inc., P. O. Box 989, Bluefield, Virginia 24605-0989. We believeThe Corporation believes that directors should possess the highest personal and professional ethics, integrity and values, and be committed to representing the long-term interests of the stockholders. We striveThe Corporation strives to havemaintain a Board representingwith diverse experience with respect to policy making decisions in business, government, education and technology, and in areas that are relevant to the Corporation’s overall business activities.

The Committee also considers candidates recommended by current directors, company officers, employees and others. The Committee evaluates all nominees for directors in the same manner and typically bases its initial review on any written materials submitted with respect to the candidate.

Meetings of Non-management Directors. The non-management directors met without any management directors or employees present two (2) times last year. Mr.Director Stafford, II served as chairchairman of these meetings.

COMPENSATION DISCUSSION AND ANALYSIS

This section provides an overview and explanation of the material information relevant to understanding the objectives, policies and philosophy underlying the Corporation’s compensation programs for executives and of